Hello Yele, I want to apologize from the onset for my numerous questions because i aspire to become a venture capitalist.

Please I would be most grateful if answers are relate-able to the way of life in Nigeria seeing we are in Nigeria.

1. what is the duration of your preferred exit/ROI when you invest?

2. What are the top 5 criteria you consider when investing?

3. Since your journey investing, what has been your biggest mistake and lesson learned?

4. What are top sectors you have invested in?

5. As a startup, what should i think of or put in place before contacting an angel investor or VC?

6. I understand the risk of investing in start ups, how do you react when a startup you invested in does not produce good returns or fails?

7. As an aspiring venture capitalist, what is are the steps in being one and your general advice? Thank you.

What is the duration of your preferred exit/ROI when you invest?

- 7-10 years (although we might sell a % shares earlier to lock profits in secondary markets)

What are the top 5 criteria you consider when investing?

* Large Market Size

* High Quality of team

* Really painful Problem / real market need

* Distribution/Acquisition Channel

* Simple business model

Since your journey investing, what has been your biggest mistake and lesson learned?

* Not sure I''ve made a big mistake yet, but we''re still early and mistakes are part of the journey

* My biggest lesson is the quality of the team matters most, so invest in quality founders that I can see myself working for.

What are top sectors you have invested in?

* Fintech

* Crypto

* Education

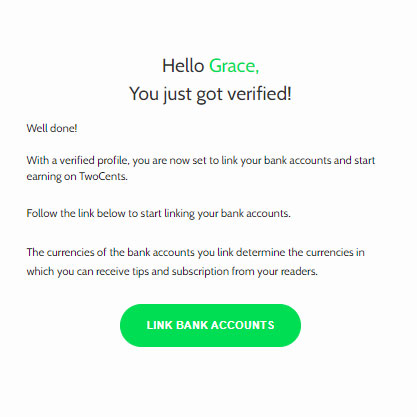

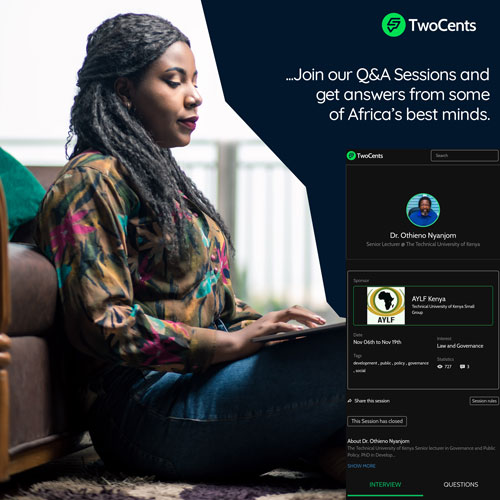

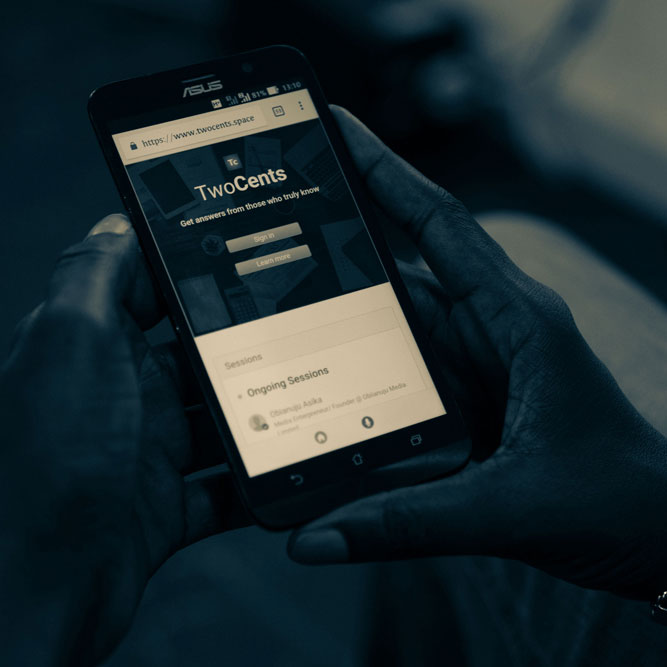

* Just done a deal in social commerce (TwoCents Exclusive)

As a startup, what should i think of or put in place before contacting an angel investor or VC?

*Have a product, show you can build something and have some users

I understand the risk of investing in start ups, how do you react when a startup you invested in does not produce good returns or fails?

* I expect at least 70-80% of my investments to fail

As an aspiring venture capitalist, what is are the steps in being one and your general advice?

* Start a startup and learn from the experience

* Try writing an investment thesis/memo on a company that hasn''t raised money and why you would invest in them, check out opentraction.com for sample investment memos

Boston

Boston

Comments